Introduction

We are reaching the end of what has been a strange year, with an Annual General Meeting looming, which will confirm the administrative and policy basis for the coming year. Information concerning the AGM is given below, and as it will also contain a social element we hope members will feel encouraged to attend.

At present future plans stand as follows.

Friday 18th June at 2.30pm – Alan’s Lichen Walk in Victoria Park. This will be the Society’s first live gathering for more than a year. Contact Alan Potter if you are interested.

Friday 23rd July at 2.30pm at All Saints’ Church Hall (Large Room) for AGM and More.

September onwards – Friday Afternoon Talks/Lectures. We hope that there will be two between September and December and two more between January and April.

Monday Morning Courses. These courses will run from 10am to 12noon with a break for refreshments. Peter Firth’s course on Norman Monarchs (Queens as well as Kings) will have 10 sessions between September and December. Roger Mitchell’s course on The Country House in 20th Century will have 8 sessions between January and March. Alan Potter’s course on The Human Brain will have between 6 and 8 sessions in April and May.

On the assumption that these plans for face-to-face meetings go ahead, the question arises about the future of this FORUM, which has provided our main service for members in the last year. Obviously there will still be a need to communicate information about SUES, but is there still a place for a journal of this kind, in which members present articles of interest ? We are anxious to hear your views on this.

Our website has undergone a major overhaul. Do have a look at it and see what you think.

We have recently heard that one of our members, Teresa Rickards, passed away earlier this year. We have sent our condolences to her family.

Annual General Meeting

At 2.30 pm on Friday 23rd July 2021

We remain optimistic that this will be a real meeting rather than a virtual one. We have booked the large hall at All Saints, which provides both space and ventilation and we are planning an event which will welcome members back in an entertaining way. As well as the AGM, which will include details of our website update, our plans for future courses and meetings and our use of Zoom and of Forum, we will also have an informal session on ‘The Positives of 2020 – 2021’. This will be led by Committee Members and will include thoughts on such topics as gardening, reading and keeping in touch. Refreshments will be served and we expect the meeting to end no later than 4pm.

Agenda and papers for the AGM will be sent to all members in mid July as part of the July edition of Forum.

Entry to the Hall will be via the car park in Park Rd.

If you are willing to make a short contribution to ‘The Positives of 2020 – 2021’, please contact Roger (details below).

To arrange refreshments and room layout, it would be helpful to have an idea of numbers and so, if you intend to come, please email or phone Roger at rg.mitchell@btinternet.com or 01695 423594 on or before Tuesday 19th July.

A Pint of Paper, Please!

When studying chemistry as an undergraduate, my final year project was to investigate the possibility of turning waste-paper into alcohol. This was in part altruistic to identify how we could protect the environment by recycling waste products to produce environmentally friendly fuel to replace that made by burning fossils. It was also in part because, being a student, the possibility of producing one’s own alcohol, very cheaply was, well, intoxicating.

The first process involved working with newspaper and this was to shred it into very small pieces and then liquidise it to produce slurry. This mixture could them be treated using natural chemicals to remove the newsprint and other unwelcome stains to produce plain paper. The slurry was then broken down further by chemical action in a blender followed by treatment in a pressure cooker to break the paper down and release the components that make up cellulose – the basic constituent of wood and, therefore, paper.

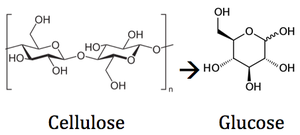

As can be seen by the equation below, cellulose is made up only of atoms of carbon (indicated by the corners where lines intersect), oxygen (O) and hydrogen (H). It is the relative proportions of these simple elements and the way they are joined together that makes different substances. When the cellulose breaks down the carbon, hydrogen and oxygen are present in different formations, this time making up sugars such as glucose (below).

Once this has been achieved, the original ‘cellulose’ mixture from paper, now containing sugars, can be converted into ethanol by fermenting it with genetically engineered bacteria. The process already exists for turning sugars from paper into ethanol using yeast, but the system needs expensive enzymes, which speed up reactions, to make the process economic.

Recent research has found this can be achieved using Zynomonas mobilis, a bacterium used for centuries by Mexican brewers to ferment the agave plant into pulque – a light alcoholic drink similar to tequila. As Zynomonas mobilis is too delicate to survive in a vat of mushy waste paper, the genes that produce alcohol have been identified and transferred into a hardier bacterium, Klebsiella oxytoca Strain P2. This strain is particularly abundant in the effluent from pulp and paper mills.

The genetically modified bacterium makes the process far more efficient, because it contains genes that break down simple sugars that yeast cannot touch. These include cellobiose – pairs of glucose molecules bound together – and several other sugars such as pentoses and hexoses.

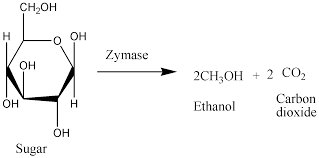

In the equation above, the simple carbon, hydrogen and oxygen are again broken down and reformed to produce molecules of ethanol (alcohol) and the waste gas carbon dioxide at the same time. This is potentially a very important process as ethanol is not just important as a constituent of alcoholic drinks – ethanol can also be an environmentally helpful constituent of petrol. In the United States up to 15 per cent by volume of ethanol is added to petrol and current consumption of fuel ethanol there exceeds 4 billion litres per year. This consumption is expected to increase as more states seek to combat vehicle pollution by outlawing the sale of petrol that does not contain ethanol.

However, making alcohol for personal consumption is still a goal for many people and you do not have to be a trained chemist either to understand the chemical processes or be able to carry out the practical steps necessary. In fact, making alcohol from waste, including paper, is something that has been known to go on illicitly in prisons for many years. There it is often known as ‘toilet wine’ but perhaps not for the reasons that might first come to mind.

Prisoners fermenting alcohol in prison often make use of the top tank of a toilet as a hiding place. The ‘brewers’ can use starting products such as waste paper but more often try to start with material where the sugar is easier to get at. Favoured items include oranges and anything sweet like cake frosting, ketchup or jelly. The sweet material is placed with water into a plastic bag with all the air squeezed out and the bag sealed. In prison, the bag is run under hot water and can then be wrapped in a warm towel or an extra pair of prison-issue clothes to increase the promotion of the chemical reactions.

After about 48 hours, the bag is carefully opened and a few teaspoons of sugar and a yeast source are added. In prison, the yeast source may be an old dinner roll or slice of bread whose mould contains yeast. Every 12 hours or so the carbon dioxide build-up needs to be released and the bag resealed.

Keeping the bag in a cool, dark place, like the top tank of a toilet, over the next few days sees the carbon dioxide production decrease, so gas release needs to be less regular. In three to five days, the fruit mixture can be strained from the liquid and there should be enough ‘toilet wine’ to try.

However, there are dangers arising from unwanted bacteria alongside the unpleasant flavours. The bacterium Clostridium botulinum, for example, causes botulism, which is a life-threatening toxin that causes paralysis. You are more likely to get this if you’re making your wine in the clink and not able to boil your mixture at a high heat or use fresh yeast. You may wish to bear these warnings in mind if you are ever in the position of taking prison ‘hooch’ production into your own hands. Still there is much to admire about people who, like us, are wishing to continue to learn throughout their lives, even if their particular actions may make their lives shorter than they otherwise might be.

Alan Potter

The Window Tax: 1696 – 1851

I must start with a confession. I have never really taken the Window Tax seriously. I have tended to lump it together with other assessed taxes such as the tax on hats (1784 – 1811), clocks and watches (1797 – 1798), on female servants (1785 – 1792), and on hair powder (1795 – 1869). These taxes were all introduced by William Pitt in a desperate attempt to reduce government borrowing at a time of war. Three of them proved unworkable and, although the requirement to buy an annual licence to wear hair powder lasted for more than 70 years, the tax was only bringing in £1,000 per year at the time of its abolition.

The Window Tax was more serious. It lasted for more than 150 years and it brought in a significant amount of revenue. The amount raised seems to have been between £100,000 and £200,000 per year, perhaps 3% of all government revenue. The Land Tax would raise about ten times more than Window Tax and government income as a whole including customs and excise rose from c£5m in the 1690s to c£20m in the 1790s. Window Tax was one of many attempts to find a ‘fair’ tax, i.e. one that taxed those who could afford to pay, taxed them at a rate that they were willing to accept and was not regarded as too intrusive, a criticism levelled at both the Hearth Tax (1662-1689) and the Income Tax introduced in 1798. No interior inspection was required for what was officially called the ‘Duty on Houses, Lights and Windows’, although assessors had the right to view all exteriors and the definition of windows as ‘any openings in the exterior walls of a dwelling through which light could pass’ was felt to be open to abuse by assessors. Most people grudgingly accepted that the number of windows in a house was a rough guide to the inhabitant’s wealth but, even so, window tax was inevitably unpopular and, as so often, the law of unintended consequences often applied.

The three pictures that follow, all show ‘false’ windows, but the question is whether they were ever intended to admit light? My feeling is that the first is about symmetry rather than light. I am not sure about the second, which is Winckley Square, Preston, but I am convinced by the third, which is a convincingly amateur blockage.

The story is an interesting and complicated one, but historians have tended to neglect it. ‘The Public Finances – a historical overview’ by Philip Brien and Matthew Keep (2018) is the best short introductions to 18th century government finances, but the window tax gets only the briefest of mentions and I have had to turn to articles by American historians for more information. Writing in 2008, Andrew Glantz of the University of Pennsylvania correctly states that ‘hardly anything original has been written on the window tax in the last 50 years’. His article (A Tax on Light and Air: Impact of the Window Duty on Tax Administration and Architecture 1696-1851) and a 2015 article by Wallace E Oates and Robert M Schwab (The Window Tax: A Case Study in Excess Burden) are my principal sources. Thanks to the wonders of Google, a simple search entry of ‘Glantz Window Tax’ or ‘Oates and Schwab Window Tax’ will have the full articles on your screen within seconds.

As we will no doubt discover in the next few years, new taxes are an almost certain consequence of excessive government spending and King William’s Wars against France in the 1690s greatly increased government debt. This was at a time when the widespread circulation of clipped coins was undermining confidence in the currency. A complete recoinage was necessary but expensive, and the Window Tax was introduced to provide extra funds. It proved relatively effective and so it was retained to raise revenue in more normal times. Over the century the rate increased and the regulations became more complex. Spencer Percival’s reforms of 1808 probably levied the highest rates and introduced the most complicated rules. A house with 6 or fewer windows paid 6s 6d per year while houses with 10 windows paid £2 16s and the amount rose steadily so that houses with 40 – 44 windows paid £28 per year. If your house had 200 windows, you would be charged c£100 per year, but even a great country house was unlikely to have so many especially as tax did not have to be paid on windows to rooms that were not lived in, such as dairies and pantries. Kitchens and garrets used as servants’ bedrooms were grey areas and, even in smaller houses, there were opportunities to move one or two items of furniture, give the room a new name and claim exemption.

It was the owner, rather than the occupier, who was responsible for payment. In the case of larger houses, most occupiers were owners, although there was a considerable amount of upmarket renting, both for country houses and particularly town houses both in London and in provincial centres and spas. Most small rented houses in the country would be exempt, or would pay only a small amount but there was a real problem with working class housing in towns. Many people lived in large apartment buildings which had been subdivided but which under the terms of the acts were regarded as single units and therefor subject to high window tax, reluctantly paid by landlords, who therefore had a financial incentive to reduce the number of windows to an absolute minimum.

Houseowners often found themselves in conflict with assessors and collectors as well as with tenants. The administration of the window tax was complex and variable. After an initial survey, national commissioners, parochial collectors and, inevitably, Justices of the Peace were all involved. Many were lazy or incompetent, some were corrupt and only at the end of the century did a more professional tax collection system develop. Pitt the Younger deserves particular credit for this, and his reforms also led to the development of an agency able to take on the even greater challenge of fair administration of the new income tax.

Enough has been said to show that collecting the Window tax was far from easy, but we have not yet introduced the aspect that gets most attention from historians, especially architectural historians. This, of course is the blocking of windows to avoid window tax. I had wondered whether this was a myth but there is evidence to the contrary, although the two different kinds of evidence, written and architectural, need to be carefully and separately considered.

The most powerful written evidence comes from 1747 and 1797, roughly one third and two thirds through the 150 years of the tax. By 1742, revenue was declining and new legislation was brought in to prevent widespread evasion. Ministers reported that:

‘The general Practice of stopping up Windows and Lights hath likewise been the greatest Prejudice to this Revenue, as the same hath been done only with loose Bricks or Boards which may be removed at Pleasure, or with Mud, Cow-dung, Moarter and Reeds on the Outside, which are soon washed off with a Shower of Rain, or with Paper or Plasterboard on the Inside.’

To prevent this, the new act prohibited ‘the practice of blocking up windows in order to evade assessment and subsequently reopening them, under penalty of 20s for every window so reopened without due notice given to the tax surveyor’.

There was another crisis in November 1797. when Pitt’s Triple Assessment Act tripled the rates to help pay for the Napoleonic Wars. The day following this new act, citizens blocked up thousands of windows and wrote in chalk on the covered spaces, ‘Lighten our darkness we beseech thee, O Pitt!’.

This evidence shows that people wanted to reduce the tax that they paid, but that they also wanted to keep their windows and their light. On the other hand, architectural evidence of surviving blocked windows indicates an acceptance of the rules with a permanent (and expensive) decision to manage with less light. Such action was, of course, entirely legal, but to what extent was it motivated solely by a consequential reduction in the window tax?

It is impossible to produce a definitive answer, but various factors need to be considered and some of them cast doubt on the assumption that every blocked window was a consequence of the Window Tax. Some ‘blocked’ windows have never been open. The period in which the Window Tax applied coincided with the period in which classical architecture prevailed and the principles at the heart of classical architecture are balance and symmetry. Even if the internal organisation of the house made an external window impossible, a blind window might be required for aesthetic reasons entirely unconnected with the Window Tax. A working hypothesis might be that the grander the house, the less likely it is that the Window Tax is involved. The Window Tax was introduced by a Parliament of landowning aristocrats and country gentlemen. It was affordable and, although sometimes a slight reduction in windows could produce a signification reduction in tax, this was much more likely to apply to small houses than large ones. Grand houses were ‘power houses’, a constant visual reminder that their owners were rich, cultured and powerful. To block up a window to save a small amount of money would be an act of desperation. If rules and rates were fixed, permanent blocking of windows (or the design of a house with the most tax efficient number of windows) might make some sense but the Window Tax was subject to constant tinkering.

It is in houses in overcrowded towns, rather than in the countryside that we might expect to find evidence that the Window Tax had an effect on building practice, although Stefan Muthesius in The English Terraced House reminds us that small houses were let off fairly lightly. A house with fewer than seven windows paid only 3s 3d window tax per year in 1821 and two years later such houses were no longer required to pay the tax. The urban poor did not necessarily live in small, individual houses. Many rented small and insanitary apartments often in older houses that had once been fashionable but were now becoming slums as the middle class moved out to the suburbs. The regulations for the Window Tax specified that houses that were subdivided into small, rented apartments as well as tenement blocks built for subdivision were to be treated as single dwellings, and it was the landlord, rather than the tenant, who was required to make the payment. It is here that there was the greatest incentive to reduce the number of windows, and while the landlord benefitted from a reduced tax bIll, the tenants suffered the consequences of reduced light and poor ventilation. It became increasingly clear that a tax which in the 18th century had been a reasonably fair means of taxing wealth, had, by the 1840s become a major cause of public health problems in the rapidly growing towns and cities of the industrial revolution. Sanitary Reformers led a campaign for its abolition and at the same time, the re-introduction of income tax in 1842 provided a more effective way of taxing wealth. The Window Tax had had its day and its abolition in 1851 was widely welcomed.

Roger Mitchell

Contacts

Chair: Alan Potter

alanspotter@hotmail.com

07713 428670

Secretary: Roger Mitchell

rg.mitchell@btinternet.com

01695 423594 (Texts preferred to calls)

Membership Secretary: Rob Firth

suesmembers74@gmail.com

01704 535914

Forum Editor: Chris Nelson

chris@niddart.co.uk

07960 117719

Facebook: facebook.com/groups/southportues

See our archive for previous editions of the SUES Forum!